What does June’s rate cut mean for you?

So, the Bank of Canada finally cut interest rates…what does that mean for you?

If you have a Fixed Mortgage, this does not mean anything for you. You will carry on as you have for the duration of the term of your mortgage, until it is time for you to renew. At which point you will then weigh your options.

If you have a Variable Rate Mortgage or a Home Equity Line of Credit (HELOC), this means that you are finally about to experience some payment relief – but how much exactly?

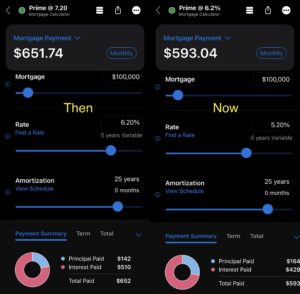

With a rate cut of 0.25%, clients will see a monthly decrease of about $15 for every $100,000 of your mortgage loan. (i.e. your mortgage is $400,000, your payments will decrease by about $60/month)

If we manage to see a 1% total rate cut by the end of the year (as some economists are predicting), clients would then see a monthly decrease of about $58 per $100,000. (i.e. your mortgage is $400,000, your payments will decrease by about $234/month)

Lower interest rates also mean that you pay less interest per payment, which results in your mortgage getting paid down faster.

0.25% is not much by any means, but it is a step in the right direction. We will continue to look to the Bank of Canada to provide us with more insight moving forward and hope that this is the start of a positive trend for mortgage borrowers.

If you have any questions about how the rate cut affects you, or if you would like to explore your mortgage options, please do not hesitate to reach out.